If you’ve ever traded crypto with leverage, you’ve probably seen this pattern:

Price moves just far enough to liquidate a cluster of long or short positions…

liquidations cascade…

and then price suddenly reverses.

To many traders, it feels personal.

Or manipulated.

Or unfair.

But what’s really happening isn’t a secret attack on retail traders — it’s how leveraged markets function when liquidity, positioning, and incentives collide.

In this article, we’ll break down:

What liquidation really means in crypto

Why large holders and exchanges don’t need to “predict” price

How liquidity clusters form

Why liquidations happen in seconds or minutes

How traders can avoid becoming the liquidity

What Is a Liquidation in Crypto Trading?

A liquidation occurs when a leveraged trader’s position is forcibly closed because they no longer have enough margin to maintain it.

A liquidation occurs when a leveraged trader’s position is forcibly closed because they no longer have enough margin to maintain it.

This happens when:

A trader borrows capital to increase position size (leverage)

Price moves against them

Their margin falls below the exchange’s maintenance requirement

At that point, the exchange automatically closes the position to prevent further losses.

Important:

Liquidations are mechanical, not emotional.

They are executed by algorithms — instantly.

When people say crypto has become institutionalized, they don’t just mean that big firms bought Bitcoin.

Institutionalization means:

Professional capital is involved

Risk management frameworks are applied

Regulatory clarity is improving

Infrastructure is mature enough to support scale

In other words, crypto is no longer treated like a side experiment — it’s being treated like a legitimate asset class.

That shift has deep implications for volatility, opportunity, and participation.

Why Leverage Changes Market Behavior

Spot markets (no leverage) behave differently than leveraged derivatives markets.

When leverage enters the picture:

Traders are forced to exit at predefined levels

Those exits become guaranteed market orders

Large clusters of liquidations can exist at obvious price points

This is where things get interesting.

In leveraged markets, price isn’t just about buyers and sellers — it’s about where forced orders sit.

What Is Liquidity (In Plain English)?

Liquidity is simply the ability to buy or sell without moving price too much.

But in crypto derivatives, there’s a special kind of liquidity:

Forced liquidity — liquidation orders that must execute when price hits certain levels.

When many traders:

Enter longs at similar prices

Use similar leverage

Place stops at similar levels

They unintentionally create liquidity pools.

And liquidity attracts price.

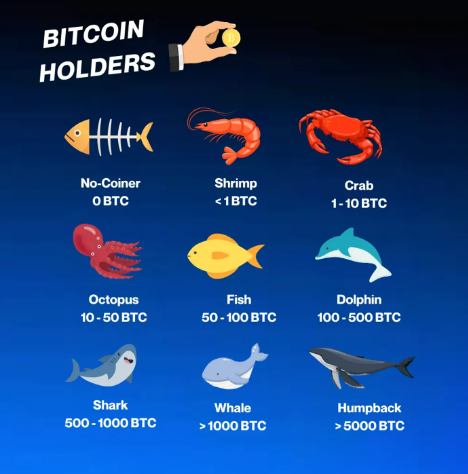

Do Big Bitcoin Holders “Cause” Liquidations?

Here’s the key distinction:

Large holders (exchanges, funds, whales) don’t need to hunt traders.

They simply operate in a market where:

Leverage is visible

Positioning is predictable

Liquidity is unevenly distributed

When large players transact:

They seek areas with sufficient liquidity

Those areas often coincide with liquidation zones

So liquidations aren’t caused by malice — they’re caused by structure.

Why Liquidations Happen So Fast

Liquidations often feel violent because of feedback loops.

Here’s how a typical cascade works:

Price enters a high-leverage zone

First wave of positions gets liquidated

Forced market orders push price further

That triggers the next layer of liquidations

Momentum accelerates rapidly

All of this can happen in seconds.

Once the cascade finishes:

Forced selling or buying disappears

Price often stabilizes or reverses

That’s why you often see sharp wicks.

Why Longs and Shorts Can Both Lose

Many traders assume liquidations only affect one side.

In reality:

Longs can be wiped above support

Shorts can be wiped below resistance

Both sides can get trapped in choppy markets

When leverage builds up on both sides:

Price may whip in both directions

Clearing liquidity above and below

This is why range-bound markets feel brutal.

Are Exchanges Like Binance Involved?

Exchanges host the liquidity — they don’t need to trade against customers to benefit.

Exchanges:

Earn fees from volume

Automatically liquidate positions per rules

Publish leverage and funding data (often publicly)

The liquidation engine doesn’t care who is trading.

The liquidation engine doesn’t care who is trading.

It cares about:

Margin requirements

Risk controls

System stability

The faster positions are liquidated, the safer the exchange remains.

Why This Isn’t “Manipulation”

Manipulation implies illegal intent.

What’s happening instead is price discovery in a leveraged environment.

Key points:

Liquidation levels are a natural result of crowd behavior

Large players trade where liquidity exists

Crypto markets are transparent enough to reveal leverage imbalances

No secret cabal is needed — the math does the work.

Why Retail Traders Are Most Affected

Retail traders are more vulnerable because they:

Use higher leverage

Trade emotionally

Cluster entries and stops

Chase momentum

Institutions and professionals:

Use lower leverage (or none)

Size positions conservatively

Focus on risk first

Expect volatility

This difference in approach explains why retail traders often feel “hunted”.

How to Avoid Becoming the Liquidity

You can’t control the market — but you can control your behavior.

Here are practical ways to reduce liquidation risk:

1. Reduce Leverage

Lower leverage = wider margin for error.

Many professionals trade with:

1x–3x leverage

Or no leverage at all

2. Avoid Obvious Levels

Crowded entries = crowded exits.

If everyone sees the same setup, liquidity will stack there.

3. Trade Less, Not More

Overtrading increases exposure to liquidation events.

Selectivity matters more than frequency.

4. Focus on Risk Before Reward

4. Focus on Risk Before Reward

Ask first:

“How much can I lose?”

Not:

“How much can I make?”

5. Understand Market Context

Liquidations often happen:

Before major news

During low liquidity periods

After long consolidation phases

Context matters.

Why Crypto Will Always Have Liquidation Events

As long as crypto offers:

High leverage

24/7 trading

Global participation

Liquidations will remain part of the landscape.

They aren’t a bug — they’re a feature of leveraged markets.

The traders who survive are the ones who:

Respect structure

Manage risk

Avoid emotional decisions

Education Matters as Crypto Evolves

Retail traders (like you and me) have to stay abreast of constant change in crypto.

Most traders fail because they:

Skip risk management

Overtrade

Ignore structure

Trade emotionally

That’s why many traders start with structured education before risking capital.

If you’re looking for a clear, beginner-friendly introduction to crypto trading, there’s a free 1-Day Trading Course that walks through:

Market structure

Risk management

Simple indicator-based strategies

Common mistakes to avoid

👉 Access the free 1-Day Crypto Trading Course here:

https://earncryptoprofits.com

No hype — just fundamentals you can actually use.

Final Thoughts

Big Bitcoin holders don’t need to predict price.

They operate in a market where:

Liquidity is visible

Leverage creates forced behavior

Structure matters more than opinion

Liquidations happen fast because they’re mechanical, not emotional.

Once you understand that, crypto trading stops feeling personal — and starts feeling logical.

The market isn’t hunting you.

It’s responding to incentives.

The question is:

Are you positioned with the structure… or against it?

4. Focus on Risk Before Reward

4. Focus on Risk Before Reward