Crypto trading doesn’t fail most people because the market is impossible.

It fails because most traders never follow a Blueprint. What is a ‘Blueprint’? A consistent repeatable pattern that produces profits.

They jump from strategy to strategy, chase hype, overtrade, and react emotionally to price movement. Over time, this leads to frustration, inconsistency, and losses — even in strong markets.

In 2026, the traders who last are not the loudest or the fastest. They are the ones who operate with simple, repeatable systems that prioritize discipline and risk management over prediction.

This article breaks down a simple crypto trading blueprint designed to help traders pursue consistent results, without staring at charts all day or relying on hype.

Why Most Crypto Traders Struggle with Consistency

Before we talk about solutions, it’s important to understand the real problem.

Before we talk about solutions, it’s important to understand the real problem.

Most traders struggle because they:

Trade without a plan

Use too many indicators

Chase entries late

Ignore risk management

Trade emotionally

The issue isn’t intelligence or effort. It’s lack of structure.

Without a framework, every trade becomes a guess. And when every trade is a guess, results are random.

Consistency comes from process, not prediction.

What a Trading 'Blueprint' Actually Is

A trading blueprint is not a strategy that tells you when to buy or sell.

It’s a decision-making system that answers four core questions:

When should I trade?

What conditions must exist before I enter?

How much am I willing to risk?

When do I exit — win or lose?

If any of these questions are unclear, the trade is skipped.

This alone eliminates many bad trades.

The Core Principles of a Simple Crypto Trading Blueprint

A good blueprint should be:

Easy to follow

Repeatable

Emotion-resistant

Adaptable to different market conditions

Complex systems often fail because they break down under pressure. Simple systems survive because they are easier to execute consistently.

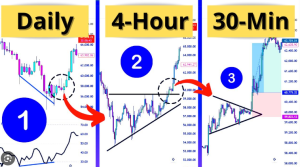

Step 1: Be Aware of the Timeframes

One of the biggest mistakes traders make is trading too small of a timeframe. In addition to the 5 minute timeframe, always check the 1 hour, 4 hour and daily charts as well.

One of the biggest mistakes traders make is trading too small of a timeframe. In addition to the 5 minute timeframe, always check the 1 hour, 4 hour and daily charts as well.

Lower timeframes:

Create noise

Increase emotional reactions

Encourage overtrading

In 2026, many consistent traders focus on:

1-hour charts

4-hour charts

Daily charts

Higher timeframes:

Reduce false signals

Improve decision quality

Require less screen time

This is especially important for traders with jobs, families, or limited availability.

Step 2: Trade Market Structure First, Not Indicators

Indicators should support decisions — not replace them.

Indicators should support decisions — not replace them.

Before taking a trade, traders using a simple framework ask:

Is the market trending or ranging?

Is price making higher highs or lower lows?

Is momentum supportive or weakening?

This provides context.

Indicators without context lead to confusion. Structure provides direction.

Step 3: Use One or Two Indicators at Most

More indicators do not mean better results.

Most consistent traders use:

One momentum indicator (like RSI)

Or one volatility indicator (like Bollinger Bands)

The goal is confirmation, not prediction.

A simple rule:

If indicators disagree, don’t trade.

No trade is better than a bad trade.

Step 4: Define Risk Before Entry

Professional traders think about risk first, not profit.

Before entering any trade, define:

Where the trade is invalidated

How much capital is at risk

Whether the reward justifies the risk

Many traders risk too much on one trade and then trade emotionally afterward.

A simple framework limits risk per trade to a small, predefined amount — allowing traders to survive losing streaks.

Consistency comes from staying in the game.

Step 5: Plan Exits in Advance

Exits should never be emotional.

A blueprint defines:

Profit targets

Stop losses

Conditions for partial exits

This prevents:

Holding winners too long

Cutting winners too early

Letting losses grow

Planning exits before entry removes emotion from the trade.

Step 6: Trade Less, Review More

Overtrading is one of the fastest ways to lose consistency.

Overtrading is one of the fastest ways to lose consistency.

A simple framework encourages:

Fewer trades

Higher-quality setups

Regular review

Instead of asking:

“How many trades can I take today?”

Ask:

“Was this trade worth taking?”

Journaling and review are where real improvement happens.

Why Simple Blueprints Work Better in 2026

Crypto markets have matured.

They now reward:

Patience

Discipline

Risk awareness

Process-driven decisions

The days of random wins from reckless behavior are fading.

Simple blueprints align with:

Institutional-style thinking

Professional risk management

Long-term sustainability

This doesn’t mean trading is easy — it means it’s clearer.

What This Framework Does NOT Do

It’s important to be realistic.

This blueprint does not:

Guarantee profits

Eliminate losses

Predict market tops or bottoms

What it does is:

Reduce emotional trading

Improve decision quality

Create consistency over time

That’s the real edge.

Why Education Still Matters

Even the best blueprint fails without education.

Most traders struggle not because they lack tools, but because they lack:

Risk understanding

Market structure knowledge

Discipline

That’s why many traders begin with structured education before committing capital.

If you’re looking for a simple, beginner-friendly introduction to crypto trading, there’s a free 1-Day Trading Course that walks through:

Market basics

Risk management

Simple trading frameworks

Common mistakes to avoid

👉 Access the free 1-Day Crypto Trading Course here:

https://earncryptoprofits.com

No hype. Just education designed to build clarity and confidence.

How Traders Use This Framework in Practice

Most consistent traders:

Stick to one blueprint

Trade fewer setups

Focus on execution quality

Review performance regularly

They don’t chase every move. They wait for their conditions.

That patience is what creates consistency.

Final Thoughts

Consistency in crypto trading doesn’t come from:

Better predictions

More indicators

Faster reactions

It comes from:

Structure

Risk management

Discipline

Repetition

A simple crypto trading blueprint removes noise and replaces chaos with clarity.

If you want better results, trade less, plan more, and follow a system you can execute under pressure.

That’s how consistent traders are built.