As the calendar year comes to a close, most retail crypto traders focus on the wrong things.

They look for:

Last-minute pumps

Holiday volatility

“One final trade” to end the year strong

Institutions do the opposite.

While retail traders react emotionally to year-end price moves, institutional investors quietly rebalance crypto portfolios with discipline and structure. They’re not trying to win December — they’re preparing for the next year.

Understanding how institutions approach year-end rebalancing can dramatically change how retail traders manage risk, reduce stress, and position themselves more intelligently for what comes next.

This article breaks down what institutions actually do at year end — and more importantly, what retail traders can realistically learn and apply.

What Year-End Rebalancing Really Means

Year-end rebalancing is not about predicting prices.

Year-end rebalancing is not about predicting prices.

It’s about risk management.

For institutions, rebalancing means:

Reviewing portfolio performance

Adjusting exposure based on conviction and risk

Locking in gains or reducing weak positions

Preparing liquidity for the next cycle

This process is slow, methodical, and boring — which is exactly why it works.

Retail traders often skip this step entirely, staying emotionally attached to positions and hoping the market “comes back.”

Institutions don’t hope.

They prepare.

Why Institutions Rebalance Crypto at Year End

Institutions rebalance at year end for several key reasons:

1. Risk Reset

Over the course of a year, portfolios drift.

Some positions grow too large.

Others underperform.

Risk becomes uneven.

Year-end is the natural checkpoint to reset exposure back to acceptable levels.

2. Performance Review

Institutions evaluate:

Which strategies worked

Which assets added value

Which positions underperformed expectations

Positions that no longer justify their risk get reduced or removed — regardless of emotion.

3. Liquidity Preparation

Institutions want flexibility heading into a new year.

Holding cash or stable liquidity allows them to:

Enter new opportunities

Respond to volatility

Adjust quickly when conditions change

Retail traders often stay fully invested and lose flexibility.

4. Regulatory and Reporting Considerations

Institutions must report results, manage balance sheets, and comply with risk mandates — forcing discipline.

Retail traders don’t have these constraints, which often leads to less discipline, not more.

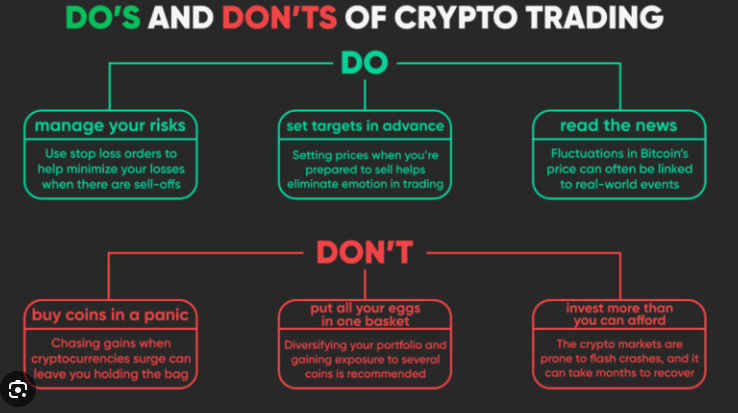

The Biggest Difference: Emotion vs Process

The core difference between institutions and retail traders at year end is emotion.

Retail traders often:

Hold losing positions out of hope

Refuse to reduce exposure because “it’ll bounce”

Chase last-minute trades to finish the year strong

Institutions:

Reduce risk when uncertainty increases

Exit positions that no longer fit the strategy

Accept that doing nothing is sometimes the best move

They don’t try to be right.

They try to be consistent.

What Retail Traders Can Learn (And Apply)

Retail traders don’t need institutional tools to adopt institutional thinking.

Here’s what can be applied realistically.

Lesson #1: Review Your Portfolio Objectively

Before year end, institutions ask one simple question:

“If I didn’t already own this position, would I buy it today?”

Retail traders should ask the same.

For each position:

Does it still fit your strategy?

Has the original reason for entry changed?

Is it adding value or just taking up mental space?

If the only reason you’re holding is hope, that’s a red flag.

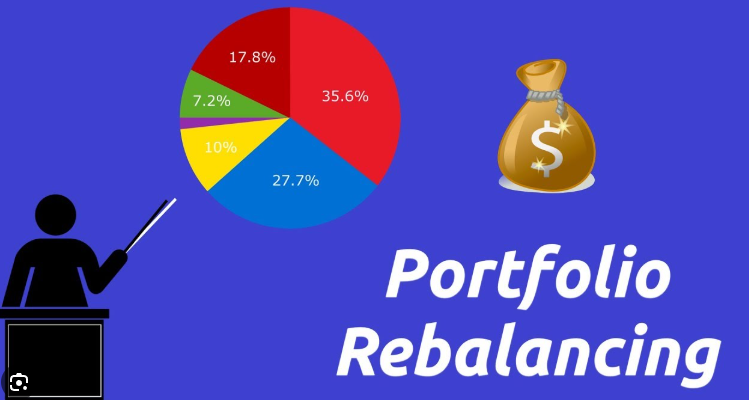

Lesson #2: Reduce Overexposure

Institutions don’t let single positions dominate portfolios unless conviction and data support it.

Retail traders often:

Go too heavy into one coin

Let winners grow unchecked

Take on more risk than they realize

Year-end is the perfect time to:

Trim oversized positions

Rebalance risk more evenly

Protect gains without exiting entirely

Reducing exposure is not bearish — it’s responsible.

Lesson #3: Lock In Some Gains Without Guilt

One of the hardest things for retail traders is taking profit.

Institutions do it routinely.

Locking in gains:

Reduces emotional pressure

Protects capital

Creates flexibility

You don’t need to sell everything.

Even partial profit-taking can dramatically improve risk management.

There’s no prize for holding through unnecessary drawdowns.

Lesson #4: Increase Liquidity Heading Into the New Year

Institutions value liquidity more than retail traders realize.

Cash is not “doing nothing” — it’s optional power.

Liquidity allows you to:

Act during volatility

Buy weakness with confidence

Avoid forced decisions

Retail traders fully invested at year end often miss better opportunities later.

Lesson #5: Stop Forcing Trades in December

Institutions don’t force activity just because the calendar is ending.

Retail traders often feel pressure to:

“Make something happen”

End the year on a high note

Trade out of boredom

Year-end is often a low-liquidity, choppy environment.

Sometimes the smartest trade is no trade at all.

What Institutions Do NOT Do at Year End

This is just as important.

This is just as important.

Institutions do NOT:

Chase holiday pumps

Enter oversized speculative positions

React emotionally to short-term price action

Treat December as a casino

They focus on preparation, not prediction.

Preparing for 2026: A Smarter Retail Mindset

If retail traders want better results in 2026, the shift starts now.

That means:

Less prediction

More structure

Fewer emotional decisions

Better risk awareness

You don’t need insider access to think like a professional — you need discipline.

🎯A Simpler Way to Approach Crypto Trading

Many retail traders overcomplicate crypto trading because they lack structure.

A simplified, education-first approach helps traders:

Understand risk before taking it

Build repeatable processes

Avoid emotional mistakes

That’s why many traders start with simple frameworks and structured education instead of chasing signals.

If you’re looking for a clear, beginner-friendly way to understand crypto trading, there’s a free 1-Day Trading Course that walks through structure, risk management, and disciplined decision-making.

👉 Access the 1-Day Free Crypto Trading Course here:

https://earncryptoprofits.com

(No hype — just fundamentals you can apply immediately.)

Final Thoughts

Year-end crypto rebalancing isn’t about predicting January.

It’s about reducing risk, protecting capital, and preparing for opportunity.

Institutions understand this — and retail traders who adopt even a portion of that mindset immediately gain an edge.

Crypto rewards patience more than excitement.

Discipline more than prediction.

Structure more than speed.

As the year closes, the question isn’t:

“What’s the next big trade?”

It’s:

“Am I prepared for what comes next?”