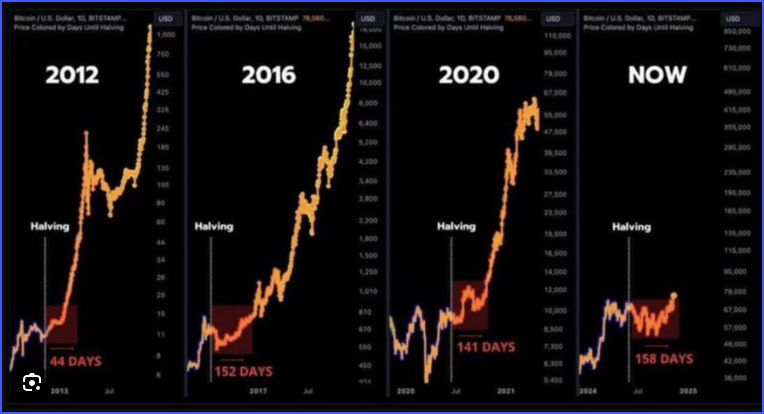

For more than a decade, crypto traders have leaned heavily on one idea:

The Bitcoin 4-year cycle.

It’s clean.

It’s predictable.

It’s simple enough that even beginners use it.

But here’s the uncomfortable truth many people don’t want to admit:

The 4-year cycle may no longer be the dominant force driving crypto markets — and institutional participation is the reason why.

This doesn’t mean the cycle suddenly becomes useless.

It means the market is evolving, maturing, and no longer reacts the same way it did in 2013, 2017, or even 2021.

If you’re still trading based solely on halving dates, you might be preparing for a world that doesn’t exist anymore.

Let’s break down why the 4-year cycle is changing, whether it’s truly “dead,” and what this means for traders in 2026 and beyond.

1. The 4-Year Cycle Worked When Bitcoin Was Mostly a Retail-Driven Asset

To understand why the cycle is shifting, you have to understand why it worked in the first place.

Historically, the crypto market was heavily influenced by:

Supply shocks from halvings

Retail FOMO

Media hype cycles

Lack of institutional liquidity

Relatively small market caps

When Bitcoin’s block reward halved, supply entering the market dropped, demand kicked in, and the price exploded. The pattern happened multiple times, reinforcing the narrative:

“Every 4 years, Bitcoin pumps. Simple.”

In a retail-driven environment where the majority of buying pressure came from emotional traders, these cyclical patterns were reliable.

But that market no longer exists.

2. Institutions Now Control a Massive Portion of Bitcoin’s Liquidity

When spot Bitcoin ETFs were approved, something historic happened:

Bitcoin became a fully integrated Wall Street asset.

It now sits inside:

Retirement portfolios

Pension funds

Wealth management platforms

Institutional balance sheets

Family offices

Hedge funds

And these entities control a staggering amount of BTC — in fact, ETF issuers alone now hold more Bitcoin than most centralized exchanges.

That matters because institutions don’t trade on halvings the way retail traders do.

They trade based on:

Macro liquidity

Interest rate policy

Risk-on vs. risk-off conditions

Volatility harvesting

Portfolio balancing

Long-term accumulation models

These forces are not tied to Bitcoin’s supply schedule.

That alone weakens the 4-year cycle’s dominance.

3. Macroeconomics Is Now More Powerful Than the Halving

In previous cycles, Bitcoin was isolated.

Now it moves in sync with global risk markets.

What moves crypto today?

Fed rate decisions

Liquidity injections

Bond yields

Global money supply

Institutional inflows

ETF demand

Economic outlook

When the Fed tightens, crypto bleeds.

When liquidity returns, crypto pumps.

That dynamic has nothing to do with halvings — and everything to do with Bitcoin’s transition into a macro asset.

This is why we saw:

Crypto rally before the 2024 halving

Consolidation after the halving

New all-time highs not long after ETF inflows

A market far more responsive to interest rates than to block rewards

Events that once dictated the market are no longer the primary driver.

4. Halvings Still Matter — But They Aren’t the Only Signal Anymore

The halving reduces supply — that part remains true.

What changed is the scale of demand.

When retail was the main buyer, the supply shock drove huge price spikes.

But now?

Institutions absorb supply dynamically.

Their purchasing power can counter or exceed halving effects.

If ETF inflows outweigh miner selling, the market pumps whether or not a halving occurred.

In other words:

The halving still causes a supply shock…

But the market no longer reacts the same way because demand dynamics transformed.

This doesn’t kill the 4-year cycle.

It just means the halving is one factor among many — not the factor.

5. Crypto Cycles May Become Shorter… or Longer

The predictable timing of past cycles may be ending.

Many analysts now believe crypto cycles will become:

Shorter:

Because algorithmic trading, derivatives, and institutional momentum accelerate price discovery.

Longer:

Because institutions accumulate slowly and deliberately, smoothing out volatility.

Which is correct?

Possibly both — meaning we’re entering mixed, overlapping cycles:

Macro cycles

Liquidity cycles

Adoption cycles

Narrative cycles

Halving cycles

Institutional accumulation cycles

Instead of one dominant 4-year rhythm, we now have multiple forces colliding, creating a more complex and less predictable market.

This is why traders who relied on simple pattern repetition are struggling.

6. The “Clean Boom-Bust Cycle” May Never Return

2013, 2017, 2021… those cycles were iconic.

But they shared one thing in common:

They were fueled by unsophisticated retail behavior.

Retail drives:

Parabolic blow-offs

Overextended hype

Meme-driven surges

Irrational mania

Brutal crashes

Institutions, on the other hand, favor:

Controlled accumulation

Strategic selling

Liquidity management

Reduced volatility

Gradual trend formation

As institutions increasingly dominate:

Blow-off tops may become less extreme

Bear markets may become shorter and less violent

Corrections may be deeper but more structured

Trends may form sooner and last longer

In other words:

Crypto may look less like Vegas… and more like a real financial market.

7. The 4-Year Cycle Isn’t Dead — It’s Evolving

Let’s be clear:

The halving still impacts supply.

Narratives still form around it.

Retail still pays attention to it.

But calling it the “main driver” of crypto price cycles is outdated.

Instead, the new model looks like this:

Old Model:

Halving → Mania → Crash → Accumulation → Repeat

New Model:

Liquidity + Macro + Institutional Inflows

Halving + Narratives + On-chain Growth

→ Complex, overlapping market cycles

This evolution is normal.

Bitcoin is becoming a mature asset — and mature assets don’t run on predictable 4-year time bombs.

Traders who understand this will dominate the next decade.

Those who don’t… will trade shadows of a market that no longer exists.

⭐ So What Does This Mean for Traders in 2026?

Here’s the bottom line:

You can no longer rely solely on halving cycles, sentiment, or simple historical repetition.

You need to understand:

Macro conditions

Liquidity flows

Institutional positioning

ETF dynamics

Narrative rotation

On-chain metrics

Risk cycles

Market structure

Complex market = complex strategy.

But the upside?

Opportunities are bigger than ever — you just need the right tools and skillset.

🎯 Want to Learn How to Trade the NEW Crypto Market? (Free Bootcamp)

If you’ve been feeling like the market is harder to read lately…

You’re not imagining it.

You’re just trading a different market than the one that existed 4 years ago.

That’s exactly why I recommend joining my FREE Crypto Trading Bootcamp.

Inside, you’ll learn:

✔ How institutional liquidity shapes trends

✔ How to trade in a macro-driven environment

✔ How to avoid FOMO traps and narrative fakeouts

✔ How to build a strategy that works in any cycle

✔ Why old retail patterns don’t work anymore

✔ How to think like a professional trader — not a gambler

It’s 100% free, packed with value, and perfect for traders who want to evolve with the market — not fall behind it.

👉 Join the Free Trading Bootcamp Here.

If you want to thrive in the new era of crypto trading, this is where you start.

Final Thoughts: Adapt or Get Left Behind

The 4-year cycle was great while it lasted.

It gave structure to a chaotic market and helped millions of traders time big opportunities.

But crypto has grown up.

Institutions don’t care about halvings.

Macroeconomics now drives volatility.

Liquidity cycles dominate price action.

Narratives evolve faster than before.

And ETFs have permanently changed Bitcoin demand.

The traders who win from here on out are the ones who stop treating crypto like a simple pattern — and start treating it like a real, dynamic global market.

If you’re ready to level up, sharpen your strategy, and trade with clarity in this new environment…

👉 Join the Free Trading Bootcamp and take the next step.

You’re entering a new era of crypto.

Make sure you’re prepared for it.