'Slippage' in Defi: What Every Crypto Trader Needs to Know

In the fast-paced world of decentralized finance (DeFi), crypto traders are often focused on maximizing their profits. They study market trends, analyze technical charts, and follow the latest developments. However, one factor that can silently erode their gains is slippage. Slippage is a critical aspect of crypto trading, especially in the volatile and dynamic DeFi ecosystem, and it’s something every trader should understand.

In this blog post, we’ll dive deep into what slippage is, why it happens, how it impacts traders in DeFi, and what you can do to minimize it. We’ll also cover the role of liquidity, decentralized exchanges (DEXs), and how various DeFi tools can help mitigate the risks of slippage.

1 - What Is Slippage?

Slippage occurs when the price at which a trade is executed differs from the price you initially expected. In simpler terms, it’s the difference between the price you see when placing an order and the actual price at which the order is completed. This usually happens because of market volatility, where the price of an asset changes quickly between the time you submit your trade and the time it is processed.

For example:

- You place an order to buy 1 Ether (ETH) at $3,000 on a decentralized exchange (DEX).

- However, due to price movement, your order is executed at $3,010.

- The $10 difference is the slippage.

While this may seem like a small difference, slippage can add up over multiple trades and can become significant when trading large amounts or during volatile market conditions.

2 - Why Does Slippage Happen in DeFi?

Slippage in DeFi typically occurs due to several key reasons:

a. Market Volatility

Cryptocurrencies are known for their volatility, and prices can fluctuate dramatically in a short period. This volatility can cause slippage as the price of an asset may change from the moment you initiate a transaction to when it’s completed.

b. Low Liquidity

In decentralized finance, liquidity is provided by liquidity providers (LPs) who supply assets to liquidity pools on decentralized exchanges like Uniswap, SushiSwap, or PancakeSwap. When a pool has low liquidity, even small trades can cause significant price fluctuations, leading to higher slippage. Large orders placed in a low-liquidity pool can result in a substantial price impact, as the available assets might not be enough to cover the trade at the expected price.

c. Trade Size

The size of your trade relative to the liquidity in the pool is another important factor. Larger trades are more likely to experience slippage because they will consume a larger portion of the liquidity pool, which can affect the overall price of the asset. The bigger the trade, the greater the potential for slippage.

d. DEX Mechanics

Decentralized exchanges operate differently from traditional centralized exchanges. On DEXs, the price of an asset is determined by an automated market maker (AMM) algorithm that balances the supply and demand within a liquidity pool. When a large trade is placed, the AMM may adjust the price to maintain equilibrium, leading to slippage.

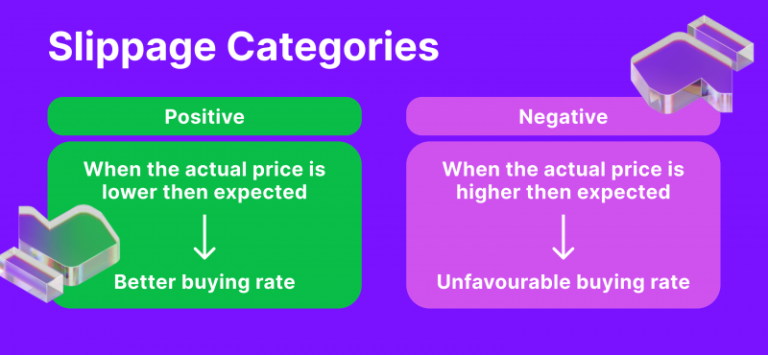

3 - Types of Slippage: Positive vs. Negative

Slippage can be either positive or negative:

Positive Slippage: This occurs when the executed price is better than the expected price. For instance, if you place an order to buy 1 ETH at $3,000 but the trade is executed at $2,990, you’ve gained from positive slippage.

Negative Slippage: This is the more common scenario where the executed price is worse than the expected price. For example, if you intend to buy ETH at $3,000 but the order is filled at $3,010, you’ve incurred negative slippage.

While traders usually notice and complain about negative slippage, positive slippage can also occur, though it is less frequent.

4 - How Slippage Impacts DeFi Traders

Slippage directly affects your bottom line as a trader. Here’s how:

a. Reduced Profit Margins

For frequent traders or those dealing with large trade volumes, slippage can eat into profits, especially during volatile periods. Even a small percentage of slippage on a large trade can translate to a significant dollar amount.

b. Increased Costs for Large Trades

If you’re executing large trades in a low-liquidity pool, the price impact caused by your order can result in significant slippage. This means you’ll pay more than you expected, reducing the overall efficiency of your trading strategy.

c. Uncertainty in DeFi Trades

Unlike traditional finance, where trades are executed at near-instant speeds, transactions on the blockchain take time. Depending on the network congestion and gas fees, your trade might take several minutes to finalize, during which the price can move, leading to slippage.

5 - Understanding Slippage Tolerance

When trading on decentralized exchanges, you’ll often come across a setting called slippage tolerance. This is the maximum price difference you’re willing to accept for a trade. Setting a slippage tolerance allows you to control how much price variation you’re willing to accept during a trade.

For example:

- If you set your slippage tolerance to 1%, it means you’re okay with the price changing by up to 1% from the price you initially see.

DEX platforms typically allow users to set their slippage tolerance manually. Most traders use a low slippage tolerance (e.g., 0.5% to 1%) for stable assets but may increase it (up to 3% or more) when trading highly volatile tokens.

6 - Minimizing Slippage in DeFi

While slippage is often unavoidable, there are several strategies you can use to minimize it in DeFi trading:

a. Choose High Liquidity Pools

One of the most effective ways to reduce slippage is by trading in liquidity pools with high liquidity. A deeper liquidity pool means that there is more supply available, which makes it less likely for your trade to cause significant price fluctuations. Before executing a trade, check the pool’s liquidity to assess the risk of slippage.

b. Break Down Large Trades

If you’re planning to execute a large trade, consider breaking it down into smaller trades. This reduces the price impact on the pool and minimizes the risk of slippage. While this approach may involve more transactions and fees, it can save you from the losses incurred by significant slippage on a single large order.

c. Time Your Trades

Timing your trades during periods of lower market volatility can help minimize slippage. When the market is calmer and prices are more stable, there is less likelihood that the price will move between the time you place your order and when it is executed.

d. Use Limit Orders

While most decentralized exchanges do not natively support limit orders (where you set a specific price to buy or sell an asset), some third-party DeFi tools or DEX aggregators offer this feature. A limit order allows you to set the exact price at which you want to execute your trade, ensuring you avoid slippage altogether. If the price does not reach your specified level, the trade will not be executed.

e. Set Reasonable Slippage Tolerance

Adjusting your slippage tolerance can help prevent unwanted price fluctuations from negatively impacting your trades. Be mindful of setting a tolerance that’s too low, as it could result in your transaction failing, especially in volatile markets. However, setting it too high can lead to significant losses, so finding the right balance is key.

f. Utilize DEX Aggregators

DEX aggregators like 1inch and Matcha are platforms that scan multiple decentralized exchanges to find the best price for your trade. These tools help minimize slippage by routing your order through the most efficient paths across different liquidity pools.

7 - The Role of Gas Fees in Slippage

Another factor that contributes to slippage in DeFi is network congestion and gas fees. If gas prices are high due to congestion on the blockchain (particularly on Ethereum), transactions take longer to process. During this delay, prices can move, leading to slippage.

To combat this, traders can:

- Use layer 2 solutions like Arbitrum or Optimism, which offer faster and cheaper transactions.

- Use blockchains with lower gas fees like Binance Smart Chain (BSC) or Polygon.

- Increase the gas fee to ensure faster transaction execution, though this comes at a cost.

8 - Examples of Slippage in DeFi

Here are two examples of how slippage can manifest in real-world DeFi trades:

Example 1: Swapping ETH for USDC on Uniswap

- You attempt to swap 1 ETH for USDC on Uniswap when the price of ETH is $2,000.

- After you initiate the trade, a sudden surge in trading volume causes the price of ETH to increase to $2,020.

- If your slippage tolerance is set at 1%, the trade will go through at $2,020, resulting in a higher cost.

- If your slippage tolerance was set lower (e.g., 0.5%), the trade would fail, and you would have to try again at a different price.

Example 2: Large Trade on Low Liquidity Pool

- You attempt to swap 100,000 USDT for a newly launched token in a low-liquidity pool.

- Since the liquidity pool only holds 200,000 USDT worth of the token, your large trade significantly impacts the token’s price.

- As a result, the price of the token increases drastically before the trade is completed, leading to substantial negative slippage and higher costs for you.

Conclusion - Slippage Awareness for Successful DeFi Trading

Slippage is an inevitable part of cryptocurrency trading, especially in decentralized finance, where prices can fluctuate rapidly due to low liquidity and high volatility. Understanding slippage, how it occurs, and how to minimize it is essential for every DeFi trader.

By using high-liquidity pools, breaking down large trades, setting appropriate slippage tolerance, and timing your trades wisely, you can reduce the impact of slippage on your profits. Additionally, utilizing DEX aggregators and third-party tools to find the best prices can help you avoid costly slippage.

Whether you’re a seasoned trader or new to the world of DeFi, being aware of slippage will help you make more informed trading decisions and protect your hard-earned profits.